Business debt can be a strategic tool for growth or a crippling liability if mismanaged. The capacity to discern between productive debt, such as loans that enable expansion, and burdensome debt, like high-interest credit, is fundamental. Debt itself is neither inherently good nor bad—it depends on its alignment with business goals and cash flow realities.

Assessing the Current Debt Situation

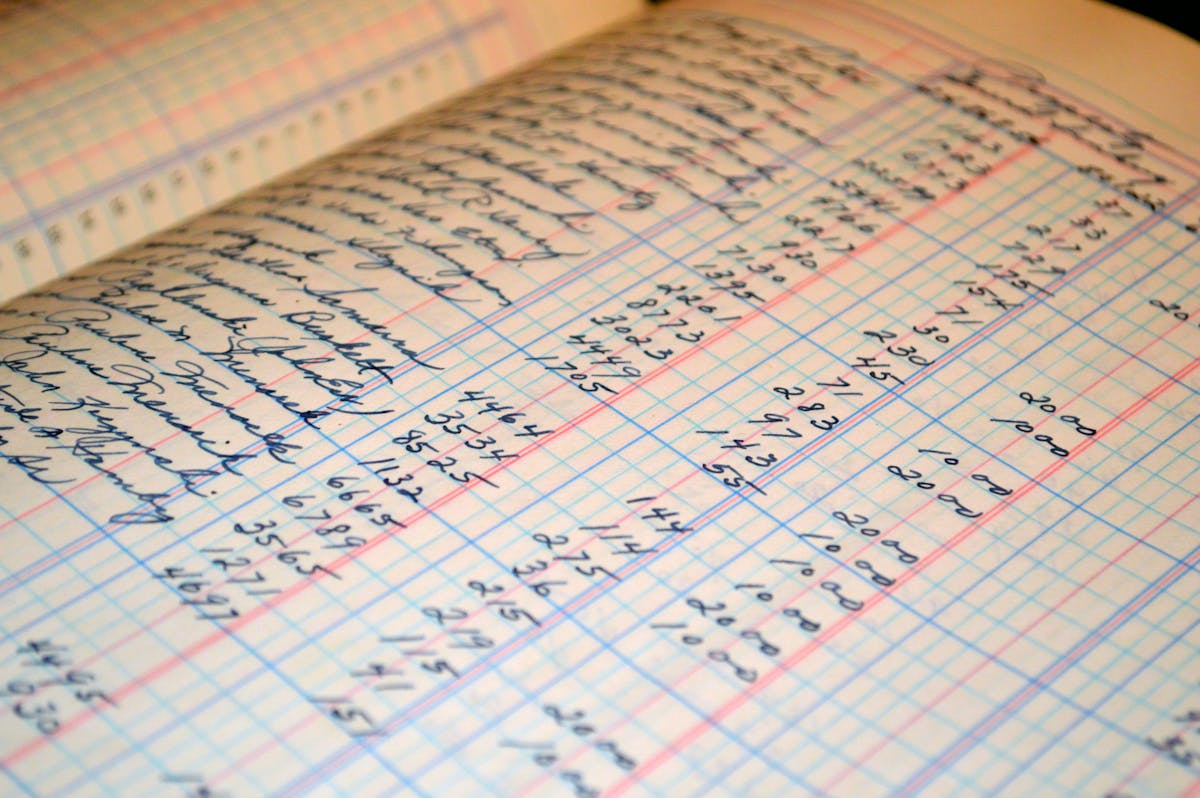

A comprehensive assessment of outstanding debt is the cornerstone of responsible management. List all financial obligations, including principal amounts, interest rates, repayment terms, and associated fees. Utilize financial software or spreadsheets to visualize monthly outflows and identify debts with the most immediate impact on cash liquidity.

For example, a retail company could realize that the interest rate on its revolving credit line exceeds that of its equipment loan, indicating an urgency to focus on repayment in that order. It is important to monitor monthly patterns in balance reduction to determine if debt levels are decreasing, remaining steady, or getting worse.

Prioritizing Debts Strategically

Both cost and risk should drive the {prioritization} process. Debts linked to variable interest rates might present increased uncertainties over the long haul, particularly in unstable economic situations. High-interest liabilities, like those from credit cards or merchant cash advances, usually intensify financial pressure. If business leaders adopt a structured plan for clearing debts—whether it be the avalanche approach (focusing on the highest interest first) or the snowball approach (tackling the smallest balance first)—they can choose a method that offers psychological and numerical benefits.

Consider the snowball method: A marketing agency has three obligations—$10,000 with 18% interest, $15,000 with 12% interest, and $20,000 with 9% interest. By tackling the 18% obligation initially, the agency lessens its interest load in the most effective way, allowing for quicker capital reinvestment.

Improving Cash Flow Oversight

Effective debt management is intertwined with disciplined cash flow practices. Accelerate accounts receivable collections through incentives for prompt payments, such as small discounts for early settlements. Negotiate longer payment terms with suppliers to retain cash in the business for longer periods. Utilize cash flow forecasts to anticipate shortfalls and surpluses, adjusting debt payments accordingly to avoid penalties or missed obligations.

A practical example: An e-commerce company schedules loan payments for the day after peak sales cycles, ensuring sufficient funds are available and minimizing the risk of overdrafts.

Refinancing and Debt Restructuring Options

Refinancing involves replacing existing debt with a new loan that typically offers more favorable terms—lower interest, extended repayment, or both. Debt restructuring may involve negotiating with creditors to adjust payment schedules, reduce rates, or settle for a lump sum less than the original amount owed.

This approach is common in sectors facing cyclical downturns. A construction company experiencing delayed payments on government contracts might successfully renegotiate its short-term loan into a long-term facility, preserving working capital during lean periods.

Balancing Growth with Debt Obligations

Responsible debt management involves finding a balance between repayment strategies and growth investments. Steer clear of the mistake of utilizing one loan to repay another without a well-defined business objective. Rather, allocate debt specifically for activities that generate income: such as funding inventory ahead of peak seasons, enhancing technology to boost efficiency, or venturing into new markets with proven demand.

For example, a startup offering software-as-a-service takes advantage of a low-interest Small Business Administration (SBA) loan to bring in more developers. This enables them to introduce a new set of features that boost customer acquisition, thus validating the use of the loan as a driver for long-term growth.

Looking for Expert Guidance and Assistance

Accountants, financial advisors, and business mentors can offer objective insights on debt strategies. They provide access to benchmarking data, identify tax implications of interest payments, and reveal government programs designed to alleviate small business debt burdens, such as emergency stabilization loans during industry-wide challenges.

Financial counseling is particularly useful when preparing for investor scrutiny or preparing documentation for refinancing, ensuring that all liabilities are accurately represented and managed.

Maintaining Vigilance and Adaptability

Regular monitoring and reassessment are crucial. Set quarterly reviews to evaluate debt levels, revisit repayment priorities, and adjust strategies in response to shifting market conditions or regulatory environments. Leverage digital dashboards to centralize financial data and trigger alerts for upcoming payments or cash flow anomalies.

Business resilience in debt management rests on proactive planning, informed analysis, and an unwavering commitment to fiscal discipline. The interplay between short-term liquidity solutions and long-term financial planning defines whether debt remains a manageable tool or evolves into a barrier to organizational progress. Thoughtful leaders who consistently optimize their approach find that debt, when wielded judiciously, can serve not just as a means of survival but as a platform for transformative growth.